Back to Blogs

Back to Blogs

Business Travel’s Permanent Dent

A New Twist on an Old Competitor

When the COVID-19 pandemic brought much of the economy to a standstill, travel was quickly and sharply affected. US air passenger volume dove 96% year-on-year for the month of April, according to the Bureau of Transportation Statistics. It is hard to imagine there is anywhere to go but up. But while a recovery will eventually come, business travel is among the sectors that faces the concerning question: Will it ever return to pre-pandemic levels? It’s our belief that while videoconferencing has been around for decades, two new applications, Zoom and Teams, are finally so good they will continue to displace a material amount of business travel even after a vaccine is available.

Those who take an optimistic view of recovery argue that human memories are short, that people tend to revert to old behavior once immediate danger passes. There is also the belief that professionals with video conference fatigue will be eager to return to face-to-face meetings that bring better business results.

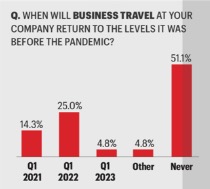

These are reasonable assumptions, but data suggest that the holders of the biggest purse strings in business travel – Fortune 500 CEOs – foresee a long-term, if not permanent dent in business travel volume. More than half of this group, surveyed by Fortune in late April, say that business travel at their companies will never return to pre-pandemic levels. And since that survey, the crisis has deepened especially in the United States. Clearly there is something going on here that is not captured by the arguments that resilient attitudes and hunger for in-person meetings will lead the sector to a quick recovery.

Even those with big stakes in the volume of business travel are coming to terms with the likelihood of its new, lower level of demand. Ed Bastian, the CEO of Delta Airlines admitted as much recently, and the ever-pragmatic Bob Crandall, former CEO of American Airlines commented: “You are never going to see the volume of business travel that you’ve seen in the past.” He expects that one-third to one-half of business travel will be displaced either by video conferencing or simply for budgetary reasons. Some large company travel managers agree with him, at least for the next few years.

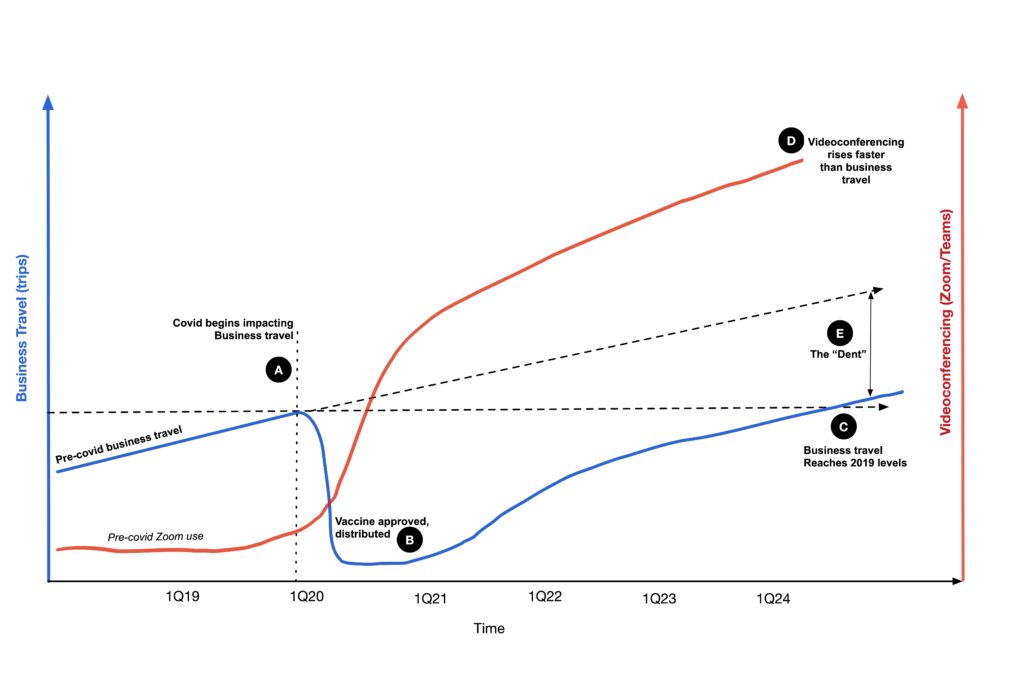

In fact, every company in business travel needs to plan for a permanent, or at least very long term, reduced level of demand for business travel. That’s not the same as saying that business travel will never again reach 2019 levels. If the global economy continues to grow, then over some period of time it may yet climb back to 2019 levels, but it will likely be a long time coming, and in that interim, videoconferencing applications will continue to eat away at the use cases that used to call for business travel.

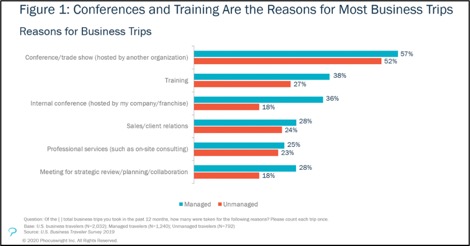

The above chart, from Phocuswright’s U.S. Business Traveler Report 2020, shows the key reasons why companies fund business travel. Conferences and trade shows have been quick to replace their physical events with videoconferencing alternatives that not only provide an effective (and Covid-free) experience but also significantly reduce the total cost of attending, whether sponsored internally or by another organization. Even conferences like ITB and CES are going digital. Training, long ripe for disruption, is following the same path with providers finding that digital offerings will be key to survival in the future.

Covid-19’s direct impact on the ability to travel safely will last until a vaccine is not only developed but also widely distributed and administered. Current projections currently target sometime in the second quarter of 2021, and in the meantime tech-based replacements for in-person collaboration will continue to be extended and refined. Health concerns will eventually decrease but will continue to be weighed and monitored more than they were in 2019. And beyond the health risk lies the reality that costs will be scrutinized as the global economy climbs back onto its feet. After a year or more of near-zero ability to travel, former business travelers are growing more comfortable with platforms that enable remote interaction, and those platforms are adding features and improving functionality. For essential corporate travel that returns while the virus threat remains significant, an entirely new kind of duty of care will arise centered on the door-to-door prevention of infection—and recovery protocols in case that prevention fails. These might diminish once the pandemic is in the rearview mirror, but this collective global experience will cause permanent change such that travel spend will never return to where it would have been in the absence of the pandemic. Businesses will recalibrate their definition of optimized travel spend, and companies that support business travel need to evolve to meet the new needs of fewer, but higher-value, trips.

Finally, good enough and getting better: Virtual meeting tech

There will always be a need for direct human contact to build trust and friendship between companies and their customers. But the coronavirus lockdown is accelerating the forward shift for a material portion of 2020’s business travel into digital channels that have recently become richer and more productive. A year or longer of saturated use of videoconferencing will give rise to a world of experts that will allow companies to unlock the value of these platforms, leading to a permanent change in how companies view the necessity of meeting in person.

A substantially easier-to-use app helps establish new habits

Enter Covid-19. Suddenly usage of a 25-year-old technology surged as millions around the world were suddenly unable to travel even as far as their offices. The people quickly crowned a new champion of video conferencing: Zoom hit 300 million daily user sessions by April, up from only 10 million the previous December. Zoom became a popular tool for everything from business meetings and live online events to fitness classes and cocktail hours. The value proposition is straightforward. It offers a seamless video chat experience, with high-quality voice and video, for a low fee and on relatively little bandwidth. But most important, it’s designed and built expressly for end users, not corporate buyers, and elevates ease of use above all else.

A familiar face seizes the enterprise-level opportunity

Zoom looks like a Skype killer and more, but it might be another Microsoft application that ultimately presents the bigger threat to business travel – Teams. Launched in 2017, Teams includes a video conferencing feature that is comparable to Zoom in many ways but is also interoperable with other Microsoft applications for document creation and storage, task management, whiteboards, Slack-like collaboration (which led to a lawsuit from Slack), and integration into the rest of Microsoft 365. This provides a significantly richer and higher fidelity creative and collaborative experience than simple video conferencing. Teams has a second advantage even more significant than its design: as part of Microsoft 365, it will be available to all those current users. Thus, an easy-to-use Teams that is well-integrated with the Microsoft Office suite could cement itself as the ultimate business platform for rich and productive meetings while Zoom continues to progress along the consumer segment.

Plenty of time to test and learn

With travel restrictions and work-from-home policies likely to last at least several more months, companies have a lot of time to test their options and learn how to maximize their benefits. And platform providers have time to roll out and test new features and functionality. It’s still early for many, but Microsoft has the potential to move us toward digital experiences where the ability to collaborate quickly and seamlessly online replaces much of value of person-to-person contact.

There also are a number of platforms designed for conferences experiencing spikes in usage. Just like the meetings software providers, these companies suddenly have a lot more users testing their products, and greater incentive to improve them. When conferences come back many more will be hybrid. That will involve more than simply streaming content. Online events and meetings don’t fully replace in person, but they will get better as we get smarter about hosting them and as the technology improves.

Beyond conferences and training, almost 90 percent of sales have moved to a videoconferencing(VC)/phone/web sales model, and while some skepticism remains, a recent McKinsey study of B2B businesses across 11 countries revealed that more than half believe this new model is equally or more effective than sales models used before COVID-19.

Outlook

The depth and length of the COVID-19 pandemic crisis will leave a permanent dent in business travel, enabled in large part by the refinement and adoption of collaboration technology that has occurred in recent years. As the market returns to that new, lower equilibrium, new needs will emerge, and every company that provides products and services for business travelers needs to position itself accordingly.

In the diagram above, point A signals the beginning of Covid’s impact on business travel with suppliers reporting drops of up to 95% in expected volumes within the first few months. Looking ahead to Point B, where a vaccine is approved, means the very beginning of a return to normalcy. It will take time to manufacture, distribute, and administer the vaccines, and the CDC is recommending that the first batches go to health care providers on the front lines (who likely won’t be traveling much for business.) Note that in the above chart, business travel and videoconferencing are on separate axes.

Bill Gates recently estimated that we could eradicate the virus in developed countries by the end of 2021 and in the rest of the world by the end of 2022. So why is the curve not crossing the pre-covid 1Q20 level until several years later? Because there are still other forces dampening business travel besides Covid:

- This year’s recession will drain corporate coffers and finance teams will be scrutinizing travel budgets like never before. If the company has been able to do much or all of its business via videoconferencing, travelers will have to justify the cost of each trip against that option.

- If business travel, the most profitable segment of the travel ecosystem, declines materially then suppliers will try to maintain their yields to the greatest extent possible by raising prices. What’s the point of ramping up capacity if you’re going to lose money on every flight, or every night? That will make business trips even more expensive than before, and see item 1 above about trip justification.

- Business travelers will have to contend not only with new rules, regulations, and procedures imposed by TSA for health assurance, but also with the new raft of policies imposed by the company itself to enforce duty of care. Remember those TSA lines and pre-trip qualification processes? You ain’t seen nothing yet!

- Some travelers will still fear the threat of contagion. Just because Covid-19 has been defeated doesn’t mean that something else won’t appear. As SARS and MERS and Swine flu gave way to SARS-COV-2, the factors that gave rise to the march of contagion haven’t stopped.

- Finally, few business travelers made their journeys because they genuinely enjoyed business travel. Some did, and for some trips, but many just found it a slog. They did it for the good of the business and in the absence of any good alternative. But that’s changed: all of these issues can be eliminated by using the “plenty good enough and getting better every day” videoconferencing options of Zoom and Teams.

Reasonable people will disagree on the size of the dent but given the reasons people travel for business and the success companies have had using the first consumer-centric videoconferencing in place of travel, an expectation of a 20-30% reduction seems downright conservative.

A major decline in corporate travel spending would have vast implications for the nation’s airlines, hotels, rental car companies and other businesses that cater to the business traveler. Business travel is significantly more profitable than leisure, which implies a significant hit to suppliers’ bottom line—and some suppliers may not make it. But there are opportunities to address new priorities and demands in the post-COVID world. These second order impacts of reduced business travel demand, and how to address them, will be taken up soon in a future post.

Previous Post

Previous Post