Back to Blogs

Back to Blogs

Previewing Our New Research Report: “Travel’s Mobile Centric Future”

Hudson Crossing is pleased to announce that the launch of our new travel industry research subscription program. Our series of reports will incorporate both proprietary consumer studies – generally large-scale studies of 2,500 or more people – and industry executive interviews. Importantly, our research is objective and independent. Though we will conduct custom research projects for clients, we won’t engage in sponsored studies, since sponsors can influence a study's questions and results. We'd also like to highlight that our research will only be written by full-time members of the Hudson Crossing team.

Our first research report focuses on mobile, a critically important marketing, sales and service channel for travel, and one whose importance will only increase in the future.

To better understand mobile’s future role in travel, we surveyed 5,067 US travelers in Q1 2013. We obtained a rich treasure trove of insights, which we analyze in detail in the full report. We’d like to highlight just a few of the many interesting discoveries we made:

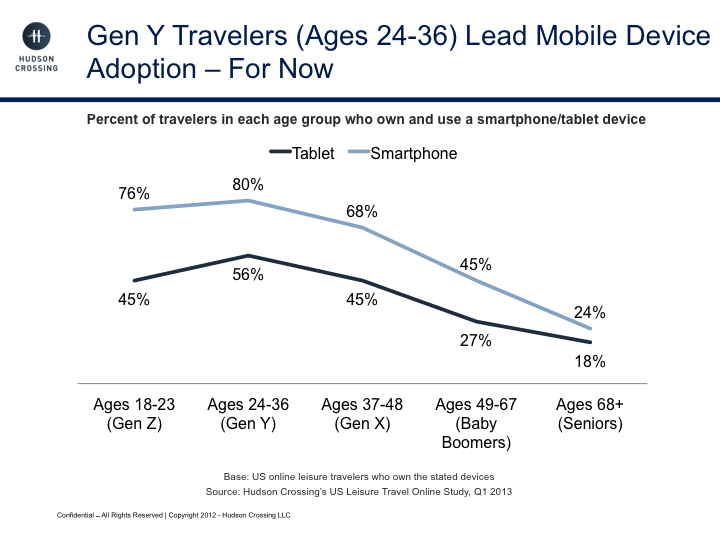

- Travelers have above-average mobile device ownership levels. Led by travelers between the ages of 24 and 36 ("Gen Y"), two in three US online leisure travelers currently own a smartphone – overwhelmingly either Apple iPhones or on Google’s Android platform – and more than two in five own and use a tablet device like an Apple iPad. Adoption of both devices exceeds that of the average American consumer, where, according to the Pew Internet & American Life Project, 46% of Americans have a smartphone and 31% own a tablet. By the end of 2018, Hudson Crossing currently anticipates that 91% of US travelers will own a smartphone and 89% will own a tablet. Among travelers who don't own a smartphone, one in five plans to buy one this year. Among travelers who don't own tablets, one in four plans to buy one in 2013.

- Mobile devices expand the amount of time a traveler spends online. In addition to smartphone and tablets, laptops are owned by most (81%) US online travelers. The typical laptop-owning traveler spends about 9.5 hours online each week for her or his personal activities such as email, social networking and, of course, planning and booking trips. Travelers who own and smartphones and tablets spend, on average, almost two more hours a week online from their devices, expanding the amount of time they spend online each week by about 16%.

- Mobile travelers are interested in mobile-based transactions. Though there are some massive mobile commerce projections being bandied about, mobile commerce (“mCommerce”) really isn’t that big today. Travel sellers anticipated that mobile would account for 5.6% of their sales in 2012, but the actual proportion is about half that. Mobile travelers are, however, interested in using mobile devices to research and plan trips. Forty percent of tablet owners are interested in booking a hotel on their tablets, as are 3 in 10 smartphone owners. Don’t expect mobile travelers to use these very different devices to make the same type of reservation. A smartphone traveler may be more interested in making a last-minute reservation, guided as much by exhaustion as location. The tablet traveler will likely use his or her device for a more considered purchase, such as the family vacation.

Much of the innovation that is taking place in the mobile space offers mobile travelers the promise of more satisfying, productive and enjoyable trips – and the promise of aiding the business relationships between travelers and travel sellers. For this to be realized, however, travel companies must embrace a “mobile centric,” rather than just a “mobile first,” philosophy.

A mobile centric approach will require travel companies to develop all customer-facing functions, interactions, and needs with mobile devices at the core of the business. This goes far beyond pagination features and “pinch and zoom” user interface design. A mobile centric culture incorporates mobile-optimized product development, product and price presentation, purchase and payment paths and processes, communications strategies and tactics – even data bandwidth.

A mobile centric travel business must rethink both front- and back-end processes – even if that means building adaptive back-end processes for traveler activities such as booking or check-in – and take full use of enterprise data warehouses and customer insights form core elements of mobile centric travel businesses. Both the promise, and imperative, of this mobile centric future stand to benefit travel sellers by being better able to anticipate and respond to travelers, including the all-important opportunity to be in a better position to sell to the traveler precisely when the traveler wants to buy.

For more information about our research program, please feel free to contact me, or email research@hudsoncrossing.com.

Previous Post

Previous Post