Back to Blogs

Back to Blogs

Et tu, Brute? So Why Exactly Did Expedia Stab Parity?

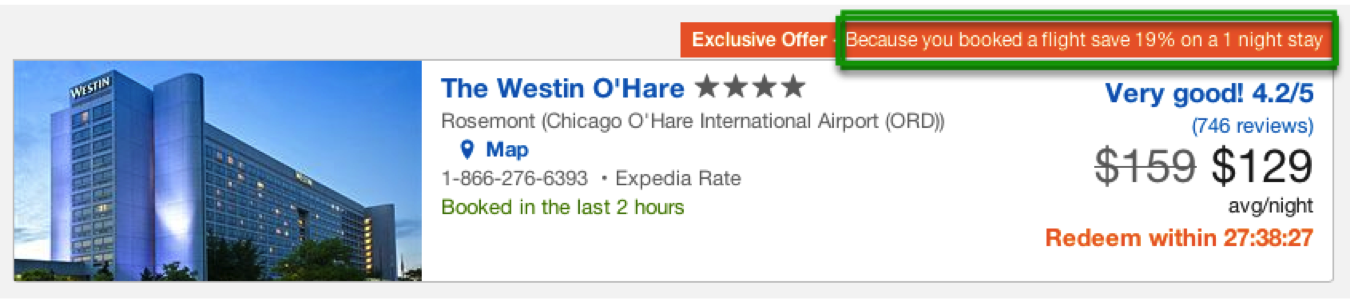

We previously published the news that Expedia is now offering hotel package rates to travellers that previously booked a flight on Expedia.

By exposing the actual rates instead of hiding them inside a true package, Expedia has stepped forward knives out, like a gang of Roman senators stalking Caesar.

As observed, Expedia undercut SPG.com by $20-$30 per night for a January 5th to the 6th stay.

At the same time, neither Orbitz nor Priceline nor Starwood/Westin itself were offering a $129 rate and the best that Google’s Hotel Finder had to show was $149 on Priceline and $159 on Orbitz.

What is going on?

We wondered at first if this was a love tap to remind brands that if they offer private rates to their loyalty program members, so can Expedia.

But we have since heard from independent sources that there is an even bigger issue lurking behind Expedia’s move.

As previously noted in Skift, starting this past summer, Google has been approaching inventory providers and distributors alike with a genial idea:

- Google’s “Limited Offers” ad product. This allows advertisers to promote discount rates within Google’s Hotel Finder to a choice of three target groups:

- All users

- All mobile users

- All users who are logged in to Google (via Gmail, etc.)

Google’s argument being that the group of all signed in Google users constitutes a “closed group” or CUG for the purpose of rate parity agreements.

We understand from sources that at this point Expedia started approaching hoteliers to allow distribution of previously fenced rates (e.g. previously only available to loyalty scheme members)

- In essence this counters Google’s declaration of a Google account as a CUG

- We hear that some brands have inexplicably consented

So not unlike Marcus Junius Brutus, Expedia can very well say “I was not alone… Gaius Cassius Longinus put me up to it”.

For whatever reason, though, this raises a huge strategic question for Booking.com: what’s the commissionable equivalent?

- And even though it might be tempting for Booking.com to approach the hoteliers enabling Expedia’s and Google’s new parity-breaking work-around to demand equal treatment that raises its own set of issues.

- For example while a merchant OTA may well drop prices if it wishes, when a retail commission OTA does starts approaching hotels and asking for like pricing, might that be viewed by some as an anti-trust/restraint of trade violation?

All this could well leave parity bleeding on the Senate floor.

Previous Post

Previous Post